Investing in an impermanent world: Lessons from mujō

- Main Story: Celebrated investor Howard Marks first encountered the Buddhist concept of mujō — the idea of total impermanence — at college.

- There are valuable lessons for all investors in the fundamental Buddhist truth that everything is in a state of flux.

- Also among this week’s stories: Swedish pragmatics, the worthlessness of news, Sam Altman’s road to AGI, and the patience of Stewart Brand.

In a recent podcast episode, William Green — author of Richer, Wiser, Happier — shared a revealing story about how Howard Marks, co-founder of Oaktree Capital Management, thinks about investing.

While studying at the University of Pennsylvania, Marks initially enrolled in an oversubscribed art class but, unable to secure a spot, pivoted to a Japanese studies course instead. There, he encountered the Buddhist concept of mujō — the idea of total impermanence.

As William explains, this unexpected detour shaped Marks’ investing philosophy. “It became a kind of guiding principle in his investing career,” he says. “He would attribute it, in large part, as a great source of his success.” He goes on to elaborate:

Key quote: “So the lesson, in some ways, that I drew from Howard that’s been life-changing for me is: you can’t predict the future. But what you can do is accommodate yourself to reality as it is. So you look at reality — everything is changing, everything is in flux, nothing stays the same. Companies that were once powerful will die, industries that were out of favor will rise again, countries that were in power will fall apart. You recognize this fundamental Buddhist truth that everything is in a state of flux, and you say, ‘If that’s the case, let me accommodate myself to reality as it is.’ So when the conditions are too ebullient, for example, and everyone is throwing caution to the wind, you want to accommodate yourself to that reality by driving a little more carefully. And likewise, when there’s too much pessimism priced into the market, then paradoxically, the market is possibly less risky, and you want to gun the engine.”

Decoding company culture through “Swedish pragmatics”

This week, I contributed a column to Big Think’s Game Change, an editorial collection that explores investing and business through the lens of sports. I’m in great company, alongside pieces from John Doerr (Kleiner Perkins), the writer Ryan Holiday, and others.

My column delves into an unexpected yet powerful idea that was introduced to me late last year: the Scandinavian approach to leadership, often called “Swedish pragmatism” by some business school professors. This philosophy asserts that true outperformance in business isn’t fueled by individual brilliance alone, but by cultivating a culture where teams — not just individuals — excel.

Key quote: “A focus on cooperation, consensus, and adaptability has long defined Sweden’s approach to business. But this type of culture is perhaps easier to see on the sports field than it is in the boardroom. Eriksson’s calm, facilitative manner demonstrated that leadership doesn’t have to be about domination — it can be about enabling others to perform at their best.”

This week in media:

My Interview on the Intentional Investor Podcast – I had a great conversation with Matt Zeigler on Epsilon Theory this week, where we discussed my pivot from investigative journalism to investing, the power of networks, and why I play the long game. Matt — an MD at Sunpointe Investments — writes a wonderfully creative newsletter here.

Daniel Crowley, CFA on the Schwab Network – My colleague Daniel Crowley — Portfolio Manager of Nightview Capital — was featured earlier this week discussing META and broader market trends.

A few more links I enjoyed:

Deep Research and Knowledge Value – via Stratechery

Key quote: “One of the most painful lessons of the Internet was the realization by publishers that news was worthless. I’m not speaking about societal value, but rather economic value: something everyone knows is both important and also non-monetizable, which is to say that the act of publishing is economically destructive.”

Tobi Lütke’s leadership playbook: First principles, infinite games, and maximizing human potential – via Lenny’s Podcast

Key quote: “Starting as a snowboard shop in 2004, Shopify has become the leading commerce platform by consistently approaching problems differently. Tobi remains deeply technical, frequently coding alongside his team, and is known for his unique approach to leadership, product development, and company building.”

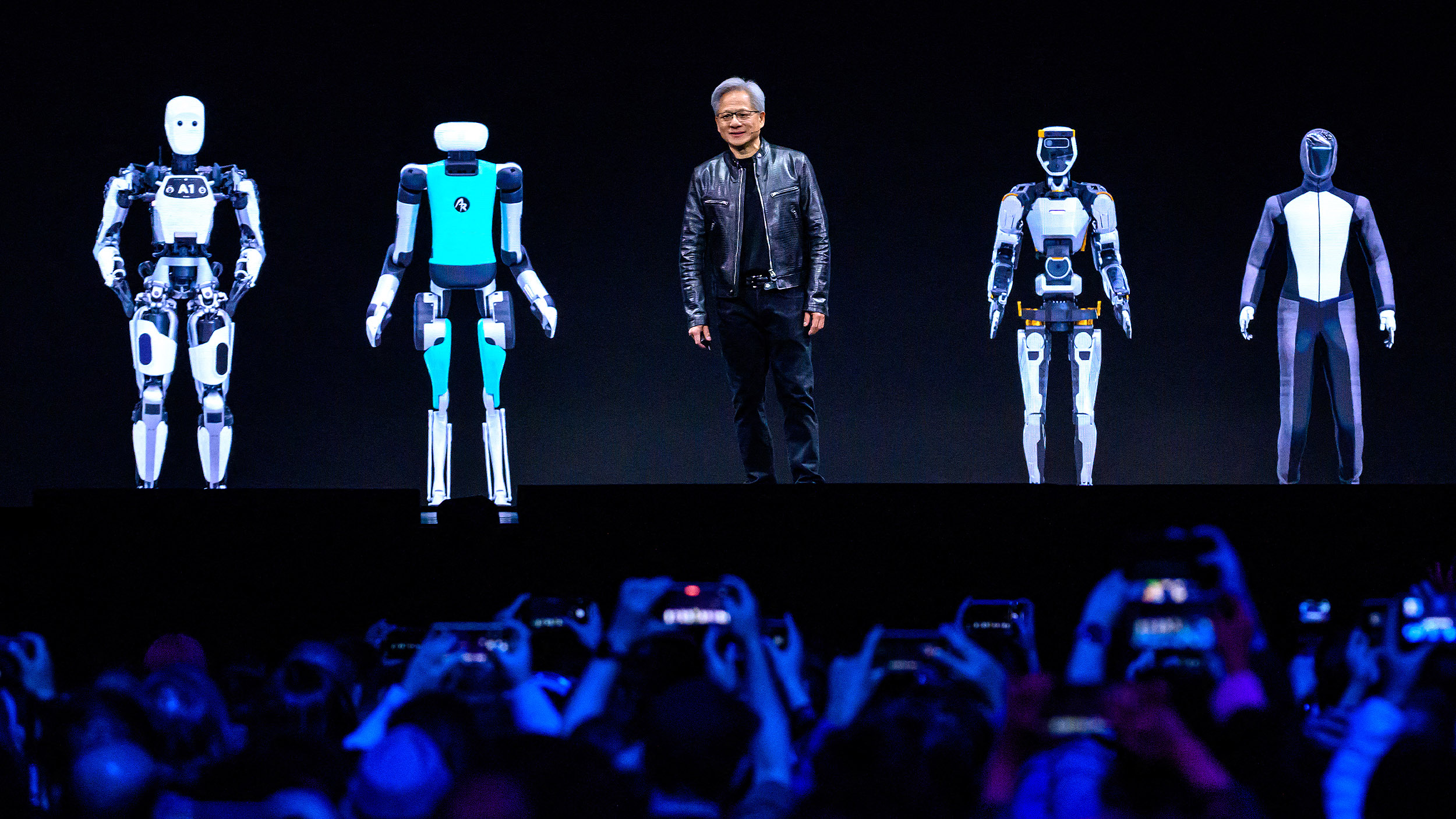

Three Observations – via Sam Altman

Key quote: “People are tool-builders with an inherent drive to understand and create, which leads to the world getting better for all of us. Each new generation builds upon the discoveries of the generations before to create even more capable tools — electricity, the transistor, the computer, the internet, and soon AGI.”

The Generative AI future beckons bright for financial institutions – via Shanker Ramamurthy

Key quote: “The interplay between reasoning models and compositionality heralds a new paradigm for AI agents. By building upon the robust foundation of LLMs and infusing advanced reasoning during inference, LRMs achieve heightened intelligence and efficiency. This integration empowers AI to engage in meaningful reasoning, enabling them to tackle intricate tasks in a structured manner by bringing together specialized capabilities — each an expert in its own domain — through agentic technology.”

From the archives:

Taking the Long View – via Stewart Brand

Key quote: “Patience, I believe, is a core competency of a healthy civilization. I propose that it is useful and realistic to think of a civilization as operating at a number of different paces at the same time. Fashion and commerce change quickly, as they should. Nature and culture change slowly, as they should. Infrastructure and governance move along at middling rates of change.”