6 Flaws in Our Understanding of the Universe

6 Flaws in Our Understanding

of the Universe

of the Universe

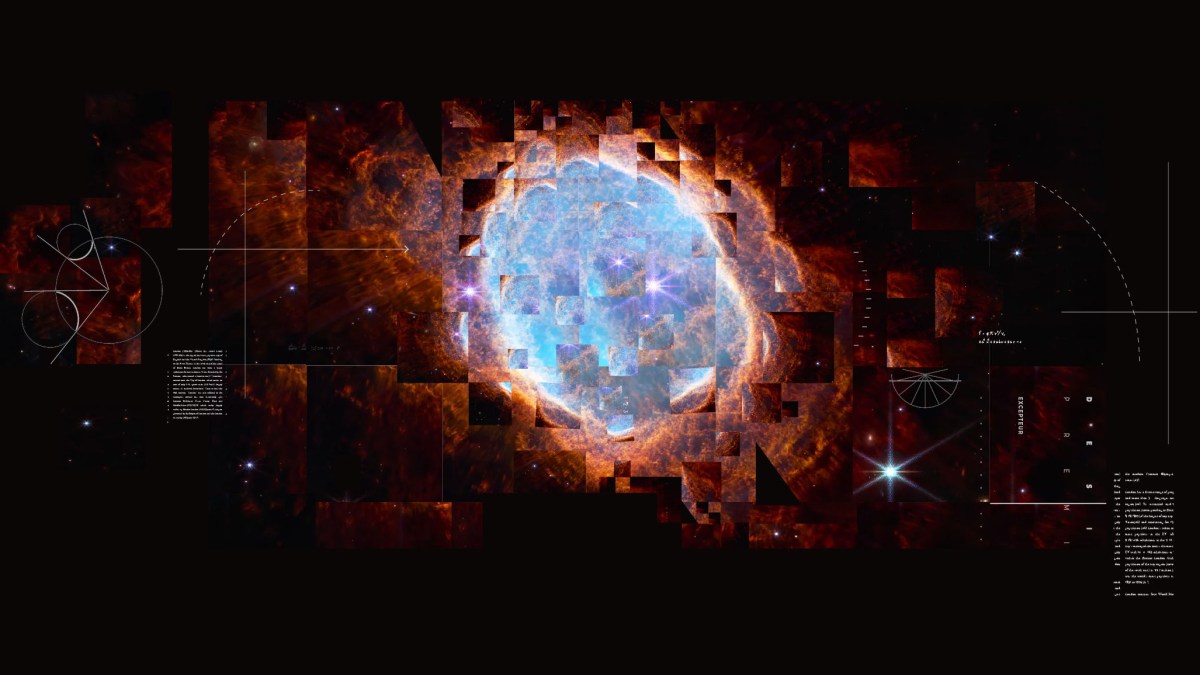

A paradigm shift occurs when unexplained phenomena overwhelm a scientific model. Though incredibly successful, the standard model of cosmology may be facing a crisis because it cannot provide a solution for at least six major problems: (1) the impact of inflation on cosmic scales; (2) quantum fluctuations; (3) the electroweak horizon; (4) Big Bang nucleosynthesis; (5) the Hubble constant anomaly; and (6) the premature formation of galaxies. In this collection of essays, we explore some of them in depth.

It may be time for a cosmological paradigm shift.

by

Cosmology is unlike other sciences.

Cosmology is unlike other sciences. When our view of the Universe changes, so does our understanding of philosophy and science itself.

Astrophysicist

Cosmology is unlike other sciences. When our view of the Universe changes, so does our understanding of philosophy and science itself.

by

How do physicists solve a problem like entropy?

by

The problem of the electroweak horizon haunts the standard model of cosmology and beckons us to ask how deep a rethink the model may need.

by

The standard model of cosmology has a big new problem: Some galaxies seem to be too old.

by

Cosmologists are largely still in the dark about the forces that drive the Universe.

by

There are two methods to measure the expansion rate of the Universe. The results do not agree with each other, and this is a big problem.

by